In this article, we want to shed light on a new preferred stock issued by American Finance Trust (AFIN).

Our goal is purely to inform you about the product while refraining ourselves from an investment recommendation. Even though the product may not be of interest to us and our financial objectives, it definitely is worth taking a look at.

The New IssueBefore we submerge into our brief analysis, here is a link to the 424B5 Filing by American Finance Trust - the prospectus (Source: SEC.gov).

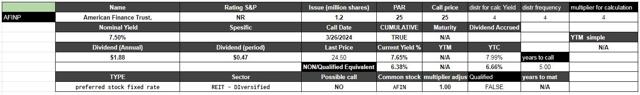

For a total of 1.2M shares issued, the total gross proceeds to the company are $30M. You can find some relevant information about the new preferred stock in the table below:

Source: Author's spreadsheet

Source: Author's spreadsheet

American Finance Trust 7.50% Series A Cumulative Redeemable Perpetual Preferred Stock (OTC:AFINP) pays a fixed dividend at a rate of 7.50%. The new preferred stock has no Standard & Poor's rating and is callable as of 03/26/2024. Currently, the new issue trades below its par value at a price of $24.50 and has a 7.65% Current Yield and a 7.99% Yield-to-Call. The dividends paid by this preferred stock are not eligible for the preferential 15-20% tax rate on dividends. They are also not eligible for the dividend received deduction for corporate holders. This means that the "qualified equivalent" Current Yield and YTC would be 6.38% and 6.66%, respectively.

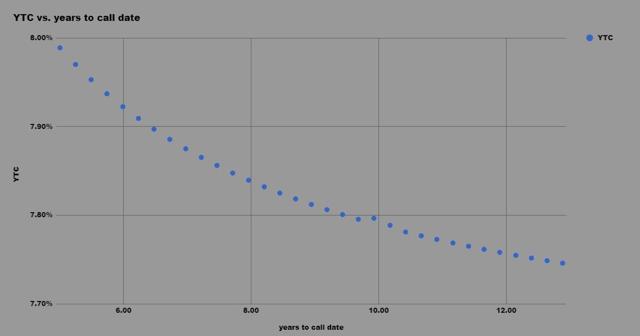

Here is how the stock's YTC curve looks like right now:

Source: Author's spreadsheet

Source: Author's spreadsheet

American Finance Trust, Inc., incorporated on January 22, 2013, is a real estate investment trust (REIT). The Company is focused on acquiring and managing a diversified portfolio of primarily service-oriented and traditional retail and distribution related commercial real estate properties in the United States.

The Company owns a portfolio of commercial properties, comprising primarily of freestanding single-tenant properties of retail properties, including power centers and lifestyle centers. As of June 30, 2018, it owned 560 properties, which comprised of 19 million rentable square feet.

Source: Reuters.com | American Finance Trust, Inc.

Below, you can see a price chart of the common stock, AFIN:

Source: Tradingview.com

Source: Tradingview.com

For 2019, the company is expected to pay а $1.10 ($0.0917 monthly payment) yearly dividend expenses for its common stock. With a market price of $10.77, the current yield of AFIN is at 10.21%. As an absolute value, this means it pays $87.96M in dividends yearly. For comparison, the yearly dividend expenses for the newly issued Series A Preferred Stock are $2.1M

In addition, AFIN's market capitalization is around $1.18B.

Capital StructureBelow you can see a snapshot of American Finance Trust's capital structure as of the time of its last quarterly filing in December 2018. You also can see how the capital structure evolved historically.

Source: Morningstar.com | Company's Balance Sheet

Source: Morningstar.com | Company's Balance Sheet

As of Q4, AFIN had a total debt of $1.52B ranking senior to the newly issued preferred stock. The new Series A preferred shares rank is junior to all outstanding debt and equal to the other future preferred stocks of the company. The Series A is currently the only preferred stock issued by AFIN.

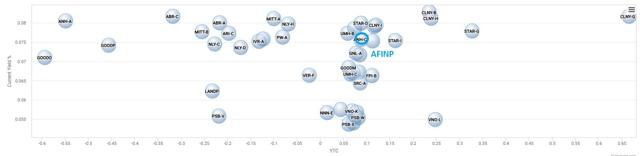

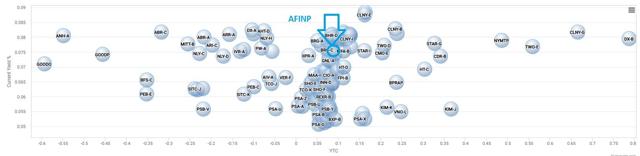

Sector ComparisonThe chart below contains all preferred stocks in the "REIT - Diversified" sector (according to Finviz.com) that pay a fixed dividend and have a par value of $25. It is important to take note that none of these preferred stocks are eligible for the 15% federal tax rate.

Source: Author's database

Source: Author's database

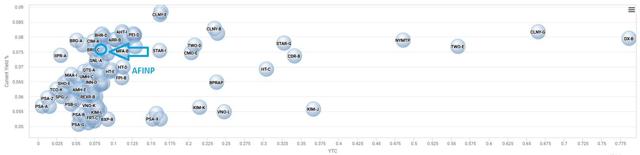

In the charts below, I'll compare all REIT preferred stocks with a par value of $25 that pay a fixed dividend rate, excluding the preferred stocks issued by CBL & Associates (CBL), as this company has a lot of problems right now:

Source: Author's database

Source: Author's database

The next chart presents only the preferred stocks with a positive Yield-to-Call:

Source: Author's database

Source: Author's database

Now, if we take a look at the main group:

Source: Author's database

Source: Author's database

Upon the occurrence of a Delisting Event (as defined below), the Issuer will have the option, subject to certain conditions, to redeem the outstanding Series A Preferred Stock, in whole but not in part, within 90 days after the Delisting Event, for a redemption price of $25.00 per share, plus an amount equal to all dividends accrued and unpaid (whether or not declared), if any, to, but not including, the redemption date (unless the redemption date is after a dividend record date and prior to the corresponding dividend payment date, in which case no additional amount for the accrued and unpaid dividend will be included in the redemption price), on each share of Series A Preferred Stock to be redeemed.

Source: FWP Filing by American Finance Trust, Inc

Change of ControlUpon the occurrence of a Change of Control, we may, at our option, redeem the shares of Series A Preferred Stock, in whole but not in part and within 120 days after the first date on which the Change of Control occurred, by paying $25.00 per share, plus an amount equal to all dividends accrued and unpaid (whether or not declared), if any, to, but not including, the redemption date (unless the redemption date is after a dividend record date for and prior to the corresponding dividend payment date, in which case no additional amount for the accrued and unpaid dividend will be included in the redemption price).

Source: 424B5 Filing by American Finance Trust

Use of ProceedsWe estimate that the net proceeds from this offering, after deducting the underwriting discount but not other estimated offering expenses payable by us, will be approximately $29.1 million (approximately $33.4 million if the underwriters exercise their option to purchase additional shares of Series A Preferred Stock in full). We intend to contribute these net proceeds to our operating partnership in exchange for a new class of preferred units, which will have economic interests that are substantially similar to the designations, preferences and other rights of the Series A Preferred Stock. We, acting through our operating partnership, intend to use the net proceeds from this contribution for general corporate purposes, which may include purchases of additional properties.

Source: 424B5 Filing by American Finance Trust

Addition to the iShares U.S. Preferred Stock ETFWith the current market capitalization of only $30M, AFINP cannot be an addition to the iShares U.S. Preferred Stock ETF (NASDAQ: PFF).

ConclusionThis is an informational article about the preferred stock AFINP. With these articles, we want to pay attention to all new preferred stocks and baby bonds, and they are a good guide to what to expect from your income portfolio.

Trade With Beta

Coverage of Initial Public Offerings is only one segment of our marketplace. For early access to such research and other more in-depth investment ideas, I invite you to join us at 'Trade With Beta.'

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.